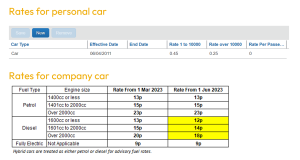

Travel Mileage rates have changes in June 2023. As such we have updated our Concur Training document for submitting your mileage expenses correctly. You can find this training guide plus FAQs document on the UK News download page here.

In summary:

Mileage

- All mileage claims must have a VAT receipt that covers the journey they are claiming for. You cannot complete a no receipt declaration for these. If you have a cash allowance instead of a company car you need to claim reimbursement for mileage by using the company car mileage section to ensure you are correctly reimbursed. Personal car mileage claims are only for those individuals who have neither a company car nor cash allowance.

Car/Van drivers – personal mileage (*09. Travel: Mileage)

- Company car/ Car Allowance – If someone has a company car they should be claiming as company car mileage, not personal. Anyone identified as a car driver and claiming personal mileage is basically being overpaid, as people will get 45p per mile instead of the fuel advisory rate for the car.

- Van drivers – The full amount can be claimed if the employee has a fuel card but has lost it or does not have it on them for some reason. Also, where they may have a hire van or additional vans required by the business. If the employee does not have a fuel card and has a company van then the company mileage section should be used.

Travel Fuel Expense (*14. Travel: Fuel)

- Company car or car allowance – No Fuel card – Drivers should all be claiming fuel as a company car driver (*09. Travel: Mileage) and being reimbursed the fuel advisory ppm rates.

- Lost Fuel card/no fuel card at time of purchase – full value can be claimed on this category.

- Fuel card is for different vehicle – When you usually have a fuel card for your company vehicle but currently using a replacement vehicle.

- Not a company driver – Not identified as a company car or van driver but if it’s a business journey then the employee should simply be claiming (*09. Travel: Mileage) as personal car mileage, 45p per mile.

Receipts

- Please ensure you obtain a VAT receipt for all fuel expenditure so that if you claim any mileage allowances the company can reclaim the VAT, which helps reduce unnecessary cost to the business. We cannot process the claim without these or need manager approval as this is extra cost for the Company.

- Exceptions: fully electric car – will not have usual fuel VAT receipts